I have been fortunate to have known so many successful people, from scientists to authors, business leaders to musicians and of course engineers to performance artists. There is a common drive and passion to these career-wise successful people. There are few obstacles in life slowing such people from meeting their objectives. At the same time, I’ve also been fortunate enough to know people who are truly talented investors. They see opportunities most don’t or at least in advance of most and have the mental fortitude to take calculated risk with conviction. In my observation, there is little correlation between the first group and second groups. To put it in other terms, the truly talented, driven and successful career minded people I’ve met don’t appear to be any better suited to investing than those who are less accomplished.

But why? My interpretation is investing, to most of the population, is an unpleasant experience. Perhaps similar in appeal to negotiating with a car salesman or cleaning the gutters on your house. People do it because they are either required to or its the right course of action; however, even knowing they could do it better is not sufficient motivation to commit the effort deserved.

With this in mind this post as a guide for the “80%” who do find investing either unpleasant or not captivating enough to warrant the attention that managing your life savings should receive. The successful people I’m referring to often have a greater nest egg then most and one would assume a greater reason for tending to it; however, I’ve noticed the size of the nest egg not correspond to increased interest or effort. My goal is to provide guidance which would allow the majority to have a successful investment strategy while requiring a limited emotional and time commitment. I’ll get to the strategy later; however, there are some important concepts which are needed to make sense of the strategy in the landscape of investment options.

Roles and Abilities

In the investment industry there are a variety of roles and responsibilities corresponding to the individuals who may take at least some ownership in directing how your assets are invested. Unfortunately, the economics / business models dictate a skill set which counterintuitively is not best suited for creating a successful investment strategy. In addition, the customer facing employees at many brokerages are not rewarded on a metric based upon the success of their customers’ portfolios so even if with the correct skills existed their goals are not aligned to your own.

The following table lists the salaries for these class of positions in broker houses and fund management, where funds are mutual funds and ETFs, Exchange Traded Funds. When you invest through a broker, your company’s 401k plan, a IRA the most commonly traded commodities are mutual funds, bonds, money market funds, stocks, ETFs and occasionally options. I’m not going to cover all of these in detail, and I’m confident there are other posts on the web which provide extensive detail on the differences between each. I will cover the important differences between some, to explain the value and limitations of the 80/20 investment strategy. The important takeaway is mutual and hedge funds are managed by people who’s responsibility is to maximize the value for the shareholders within some defined limitations. Similar, but importantly different than the executives of publicly traded stocks.

| Organization | Title | Salary (in $1000s) |

|---|---|---|

| Brokerage | ||

| Broker | 53-130 | |

| Sales Manager | 106 | |

| Sales Director | 160 | |

| Regional Manager | 220 | |

| VP of Sales | 560 | |

| CEO | 6,000 | |

| Fund Management | ||

| Quant (Average) | 525 | |

| Fund Manager (Average) | 550 | |

| Fund Manager (Top Performer) | > 10,000 | |

| Hedge Fund Manager | > 100,000 |

This data is imperfect, I’ve only provided a range for broker’s, salaries will have a geographic cost of living component, while the more senior salaries have a large annual variance and will vary from company to company. The important take aways from the table are:

- The only person on this list you are ever likely to contact is the broker. Brokers / Customer Service Representatives / Financial Planners, are typically assigned clientele based on performance, the better performers provide service to the clients with the larger portfolios. Note a “better performer” does not necessarily generate better returns for the customer, but better returns for their employer.

- The difference in pay between a Fund Manager / Hedge Fund Manager and Broker / Customer Service Representative / Financial Planner.

Mutual Funds and ETFs

Before I describe my strategy the remaining concepts cover the difference between investment options. I will keep this brief and push some of the supporting discussion and data to later sections for those who are interested. Historically investing in “the market” meant purchasing an Index Mutual Fund. Index Mutual Funds are offered by all major Mutual Fund companies for a large variety of indexes. Here’s a link to Fidelity’s index fund offerings. I have no affiliation with Fidelity and do not have any of my investments in their funds. I use them as a reference as they are one of the largest if not the largest Mutual Fund provider. For the purpose of this discussion, I will keep the indexes of choice to either the S&P 500 or the NASDAQ 100. The NASDAQ 100 are the top 100 companies, by market capitalization, on the NASDAQ exchange. Many of the largest technology companies, such as Apple, Microsoft, Amazon and Facebook, are traded on NASDAQ, so a NASDAQ index is more technology centric. The S&P 500 will also include those companies; however, at a lower percentage. The S&P 500 will also include more non-technology centric stocks like Coca-Cola, Caterpillar and Johnson & Johnson. If you have or were to open an account with an on-line brokerage, such as E*Trade, or contact a traditional broker you by default will be able to buy and sell Fidelity’s S&P 500 index mutual fund, Fidelity® 500 Index Fund, and Fidelity’s NASDAQ index mutual fund, Fidelity® Nasdaq® Composite Index Fund. I do my trading with E*Trade; however, that is personal preference. Many of the more service oriented brokers offer investment services to try to help you invest; however, the overall point I’ve made is these people are simply not qualified to provide you with information which will better serve you than the guidance I’m providing. My goal is to provide you with enough information that you feel comfortable with letting the professions you are in contact with that you need nothing more than the ability to buy and sell on your own.

ETFs or Exchange Traded Funds are different in construction and tax consequences than Mutual Funds; however, just like index mutual funds index ETFs provide an investment according to an index and thus will outperform the majority of investment funds for the corresponding market. Fidelity also offers an S&P 500 ETF, iShares S&P 500, and Fidelity’s NASDAQ index ETF, Fidelity® Nasdaq Composite Index, which should be available for trading from any of the more popular brokers. Given the choice for investing in a mutual fund or an ETF for the same index, I will always choose an ETF. The construction of an ETF as an investment option separates the purchaser from the activity which occurs as a result of the ETF owning the stocks in the indices that a mutual fund does not. In a mutual fund, when a stock owned by the fund generates a dividend a cash payout is provided by the company to the mutual fund holding the stock. These proceeds are rightfully distributed to the holders of the mutual fund, creating a tax event, regardless if the mutual fund holder elects to reinvest the dividends back into the fund or take the dividends as cash from the fund. In addition an index fund of any type will have to buy and sell shares of the stocks in the index to keep the ratio of stocks matching the ratio of stocks in the index. It is in both the best interest of the mutual fund manager and the mutual fund share holders for the turnover, the buying and selling of shares, to be kept towards the minimum possible. As a result the turnover is typically between 3% and 5% of the total value of the mutual fund. Dividends coincidently also typically generate between 3% and 5% of their stock value annually. This 6% to 10% being sold annually results in taxes being paid on that 6% to 10% of the total annually, effectively reducing the rate of return. In the end you will end up paying taxes on all of the gains with either an ETF or a mutual fund; however, paying immediately reduces the investment principal the gains will be applied for each subsequent year and lowering the lifetime gains of the investment. It will vary depending on your marginal tax rate, rate of return; however, over a 30 year window with typical values the difference was about 3% of the total. The other annoyance is the additional effort required to file your taxes every year. It is safe to assume that the 80% who don’t enjoy the investment process also by in large don’t enjoy working on their taxes. For these two reasons, when selecting an index fund, I always select an ETF.

Strategy

This strategy is very straight forward.

- Put away a small fraction of each paycheck and a larger percentage of any unplanned income (bonus, stock award) into a separate account until you have enough to buy one or more shares of an index ETF. E*Trade currently, and others I assume, will allow you to hold an account with any balance without fees. So your brokerage account could be this separate account.

- Select an index ETF to start with. Depending on your interest in investing changes over time, you might never invest in more than one.

- Keep saving and investing on the ETF when you can afford to. Do not try to guess when the market will be at the lowest point to buy. The best investors fail to time the market well, so don’t even try. Mitigate your risk by regularly buying

- Leave the investment alone as much as possible. We can not anticipate all of our financial needs; however, as a rule try to keep your investment untouchable. Stock prices and therefore the indexes that are based on those prices fluctuate and will drop. If you happen to invest at the worse possible time it can take years to regain your losses. This strategy uses a simple approach based on the long term averages for stock market index returns. If you find yourself forced to sell, you can break the assumption of long term stock market index returns and either not make as much or even loose money on your investment.

- Have the confidence to rebuff offers from brokers and service advisors on how to invest your income. The vast majority of those individuals, regardless of how well intended they might be, will not outperform this strategy.

- Ignore market prognosticators. On the investment news feeds I receive, about one to two times a month there will be an article claiming that an expert is predicting a market collapse or meltdown. Often these individuals claim to have a track record of predicting previous events. The market will have meltdowns / crashes / adjustments; however in the history of the market it has always rebounded and over the long term grown at a rate better than other investment options.

Which Fund to Pick

If I was given the option of picking a single fund for all my investments I would select a NASDAQ 100 index ETF. There are many nearly identical funds such as Fidelity’s NASDAQ index ETF, Fidelity® Nasdaq Composite Index, which I mentioned earlier. For reasons not relevant to this article my NASDAQ index ETF of choice is the Invesco QQQ ETF. I personally believe that technology companies will continue to have an advantage of being more agile than traditional companies and, as a result, over the long term expect the NASDAQ index to outperform the S&P 500; however, that is not the most conservative approach and may not be suitable for everyone. If you are conservative with money by nature, an S&P 500 index fund, such as Fidelity’s S&P 500 index mutual fund, Fidelity® 500 Index Fund, mentioned earlier might be a better choice.

If you want to be more aggressive, there are ETFs which offer multiple gains / losses relative to an index. They use more complex investment vehicles to try to construct a portfolio which will provide 2x, 3x or even 4x the returns of an index. While on the surface these may sound amazing there are no magical solutions in investing. Increased returns come with increased risk. These funds will both go up and down much faster than the index itself, so any money invested should have a proportionally longer investment horizon – you should plan on being able to not need your money for 20+ years should you invest in these funds. These funds also make assumptions on market volatility. If the market moved up and down more frequently than expected by the fund managers, the overhead of the underlying investment vehicles would cut into the value of the fund and could theoretically take the value to zero. The higher the multiple the greater the losses will be when the market is more volatile.

There are also ETFs that specialize in market sectors, such as technology, medical and industrial. There are ETFs which focus on specific international markets or even broadly over many international markets. I do not have the expertise or honestly the time to evaluate and make recommendations over these categories of ETFs. The United States has long been the standard currency that other currencies are measured against and as a result the markets in the United States represent a safe haven for international investors, so starting with a US Index fund is a conservative approach. Over a lifetime of investing, this may change and for some investors, having a percentage of your total investments outside fo the US may provide a degree of insurance. Again this deviates away from the purpose of this strategy to apply to the majority if investors.

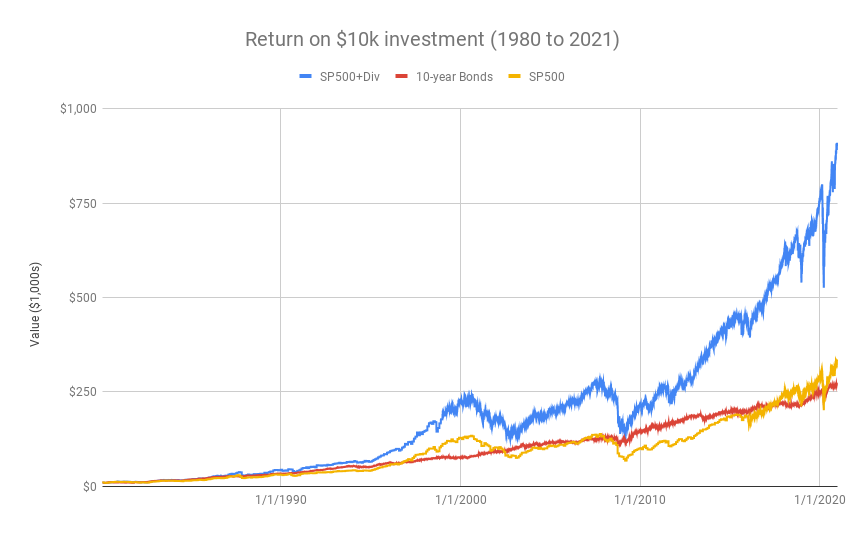

The Myth in the Value of a Balanced Fund / Stragegy

One of the most commonly pushed investment vehicles is the balanced fund, typically a mutual fund which has a target percentage of the fund invested in each of stocks, bonds and money markets. Often these funds will change the percentage of investment for your holdings based upon your age, lowering stock exposure as you get older. Aside from the previously mentioned issue of fund manager performance, these funds all suffer from being hyper-conservative. Over any 20 year period in the last century (and likely before then as well) stocks indices have outperformed bond and money markets, which means if you are investing over the long term you will make significantly less invested in balanced fund due to the investments in the bond and money markets over and above the additional relative losses made by the underperforming fund manager. The only justifiable reason to invest in bonds is if you are pulling money from your investments, such as in retirement. The safeguards provided by a balanced fund are not likely valuable. The event(s) that would so sufficiently wipe out “the market”, getting past all of the safeguards put in place to prevent such a meltdown from occurring would likely destabilize society so you would not have the opportunity to access your funds. Investing in a balanced fund is roughly akin to taking life insurance specifically for the possibility you are struck by lightning. You are being so conservative you are effectively throwing your money away. This is not to say there is not value in moving your investments or fraction of your investments to more conservative investments as you age; however, if you are saving for retirement, ignoring potential medical expenses, the goal is to not outlive your saving. One needs to trade off the risk of living a longer life and needing more income against the risk of loss of income due to being forced to withdraw from the market during a low in the market. While the average life expectancy in the US stands at roughly 78, once you have reached age 65 the average life expectancy from that point forward is 88 years and 15% of the population will live to be 95. This means retirement income will typically be spread out over more than 20 years and 30 years is not unlikely. If you are trying to maximize the average 20+ years based on history is enough to absorb even the worst stock market downturns. If you are unfortunate to not live as long, the risk of your nest egg not being sufficient also drops, so your sensitivity to a market swings effect on your assets also drops. Footnote: after completing this article a post on Morningstar.com made essentially the same argument for a more aggressive portfolio based upon increases in expected lifespan from the age of 65.

To put this into numbers if you simulate the return from all stocks in any twenty year period starting from 1980 85% of the time your average income will be higher than if you invested solely in bonds. If your nest egg was enough to provide an average annual income of $100k from stock investments then you would have received an annual income from bond investments of $82k.

What about the 15% of the time. It is true if you went all in on stock at the hight of the tech bubble in 2000, your income would have been only $41k; however, the worst performing bond timing going all in on bonds in 1999 would have produced an average income of $61k. So it is true, if you are being conservative some bond investment provides protection from stock market downturns.

I would suggest looking at protection from bonds as a type of insurance. Instead of following the conventional guidance of increasing the bond content of your investments as you age, if you are looking at a 20 to 30 year investment window include some bonds at the beginning of window, should you find yourself unlucky in your timing (Remember it’s not possible to time the market). If you start with 70% bonds / 30% stocks and take your income until the bonds have a zero balance, over any 20 year period starting in 1980 you will on average have an income of $93k and never have an income as low as if you had invested entirely in bonds. So on average the insurance will reduce your income by 7%; however it provides protection keeping your minimum above $61k versus $41k of being invested in stocks alone.

Warning: The provided guidance is likely conservative, based upon exhausting retirement savings over a 30 year period. If your retirement savings are more than sufficient to cover your needs over a 30 year period, then the percentage of bonds initially invested should be lowered. The bonds are fulfilling the role of insulating your stock investments from being sold at a low point as a result of the market correcting shortly after the start of your investment window. If the bonds are sufficient to cover your income for nearly the period of the downturn, then having a greater fraction invested in bonds will only reduce your nest egg over the 30 year period. So if you have twice what you expect to need, then start at 35% or three times your needs then start at 70%/3 = 23%. If your retirement savings are not sufficient to cover your needs over a 30 year period a tradeoff the risk that you will outlive your savings versus the risk of a market downturn in the first few years after you start drawing from your savings. Unfortunately, predicting the market is not possible and predicting your lifespan accurately is possibly only moderately more accurate.is

Strategy Summary

To summarize:

- Prior to retirement, regularly set aside some of your income and invest in an index ETF. Make a sincere effort to set aside funds for a long period, to reduce risk and maximize the benefits of compounding that an ETF provides. Check on the value of the ETF infrequently, but at least once a year.

- As you approach / enter retirement, set aside the appropriate percentage of your nest egg in a bond fund or bond ETF, according to your income needs and your risk tolerance and potentially your state of health.

- Do not expect that anyone in the financial services industry will act in your best interest and be confident knowing that they will not likely be able to outperform your simple strategy.

- Never try to time the market.

401ks, IRAs and 529s

401k – I am a strong believer in a 401k as a required retirement investment vehicle. I’ve never seen a 401k plan offered which did not make sense for to invest in to the maximum allowed. 401k plans defer taxes on both the contributions to the plan and on the gains in the plan. There are plenty of other resources on the web which do justice to how valuable this is so I will not spend the time demonstrating the value. My thoughts are everyone should be contributing to their 401k to the maximum allowed. I do not believe that 401k plans are designed first most for the individual account holders. In all of the 401k plans I’ve participated in, the options for funds to invest in have been very limited, always mutual funds and most often poorly performing mutual funds. When faced with a decision about how to invest within your 401k account, the lowest energy method is to look for an index fund, as described above, from the limited list provided. Otherwise, I would recommend the approach I used prior to shifting my investments to index fund ETFs described in the Strategy Evolution section below. When you do leave your employer, who sponsors the 401k plan, transfer your funds to a rollover IRA under the same broker you manage your other investments with. Once it is a rollover IRA you will no longer have the restrictions placed on the plan.

IRA – If your employer does not offer a 401k plan you should be investing in an IRA to the maximum possible. IRAs have the benefit of not having the investment restrictions typically found in 401k plans; however, the also lack the employer matching contributions typically found in 401k plans. Traditional advice is not to contribute to an IRA if you have access to a 401k plan. For most people I would agree, IRAs come with additional rules and penalties should you need to remove funds, and if you already have a 401k plan no tax deferral on the contributions is allowed. Given my strategies concept of buy and hold an index ETF provides tax sheltering of gains (provided the ETF is not sold), there is not much of a tax value for a buy and hold strategy. The following is not part of the 80/20 rule. An IRA in addition to a 401k can provide tax sheltering on investments made in short term vehicles. In my case I will trade LEAPS, Long Term Equity Anticipation Security, which have a fixed expiration date creating a tax event in two years or less. LEAPS are higher risk and therefore higher reward and should really only be used on funds you can afford to loose outright. As a function of my career I’m exposed to information at times that I believe provides me insight into how specific companies may perform. I use my IRA account as the holding fund for these higher risk investments as the tax treatment is favorable.

529s – I have two children and hope they both will graduate with a career-oriented degree. I looked at 529s and found them to be disappointing. They suffer from the same limitations placed on 401k plans, with limited investment options and have an additional set of rules complicating the use of the funds. For myself and I believe the majority of others, a 529 did not add value over and above following the strategy of investing in ETF index funds. The one reason I can see for creating a 529 account is it provides a transparent location for others to donate funds. If the case exists where say the grandparents would be willing to donate, but are concerned about the funds being used for the intended purpose a 529 brings a law based formality to the funding of a child’s post secondary education. If for this or other reasons, you do decide to open a 529 I would suggest you do your homework and find one that provides the best performing investments and the greatest flexibility in how the funds can be used. I live in California, but found the Nevada 529 to be the best suited, even if I chose not to open a 529. We opted instead to open two additional accounts under our broker and maintain our children’s accounts as we do our own investment accounts.

Strategy Evolution

I’ve been actively investing since the early 1990’s and have adapted my strategies over time. It is important to re-evaluate every few years or should there be a change in the tax laws. My primary strategy originally focused on finding mutual fund managers who had demonstrated outperforming the market for an extended period. To find these managers took some effort in finding a top performing fund and then determining how long the management for that fund had been in place. It has become more challenging over time to find such funds and given there is lost ground to index ETFs in terms of tax consequences and the time needed to attend to these investments, I’ve moved away from this strategy; although, I do still hold on to two mutual funds I purchased over 20 years ago that have served me well. At some point the fund managers will move on and so will I. If this is a path you wish to consider, I would strongly encourage you to open an account with Morningstar. I have no affiliation with Morningstar. They do offer straight forward and comprehensive information on funds.